Blur Dominates NFT Lending Market With 82% of All Loan Settlements Across the Sector, Dappradar Study Reveals

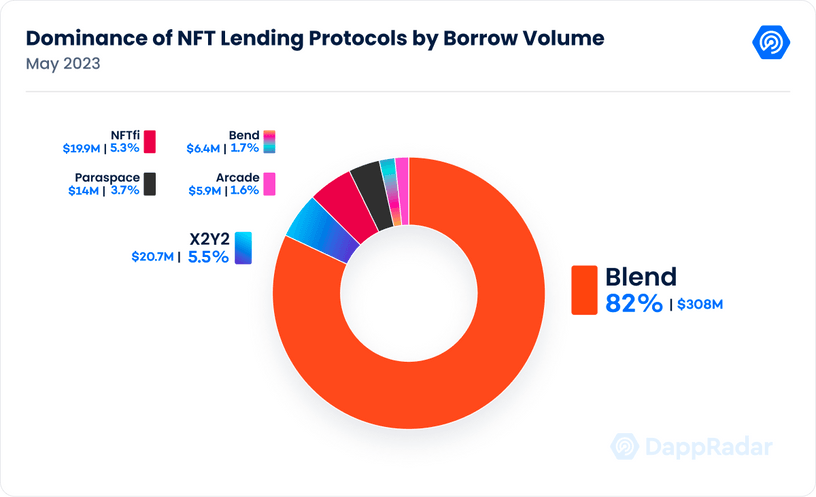

A recent study by Dappradar discloses the May loan volumes for non-fungible tokens (NFTs) reached a high of $375 million. The findings emphasize the significant influence of Blur within the NFT lending market, as the NFT marketplace platform constitutes 82% of the entire value settled in the NFT lending sector.

Blur Emerges as NFT Lending Giant, Capturing 82% of Market Share

Not long ago, Blur proclaimed its entry into the NFT lending arena, and since then, it has logged $308 million in NFT loan volume. This information stems from a May 25, 2023, study published by dappradar.com, indicating that 46.2% of the NFT marketplace’s transactions now involve loan activities.

The dappradar.com report accentuates how Blur unveiled its lending initiatives on May 1. On the same day, it registered 4,200 ether and has since escalated to 169,000 ether following its inception. Dappradar’s analyst notes that Blur’s weekly loan volume “outperformed other centralized platforms by approximately 2.93 times.” Blur’s NFT loan volume equates to 82% of all NFT lending settlements throughout the industry during a 22-day period.

Sara Gherghelas from Dappradar explains that while Blur has monopolized NFT lending volumes across the sector, the trading volume on their platform has diminished. “The trading volume over the past seven days was $104.35 million, a 15.93% decline from the preceding week,” Gherghelas states. “This shift suggests that Blur is currently being primarily used for loans rather than trading. In fact, in the last seven days, nearly half (46.20%) of Blur’s activity originated from NFT loans, transacted by an average of 306 unique daily users.”

The fluctuations in trade volume might be ascribed to Ethereum’s overall decrease in NFT sales over the last 30 days, sliding 26% lower than last week. Conversely, Bitcoin-based NFTs have taken center stage, securing roughly $175,084,024 in NFT sales over the previous month, as data from cryptoslam.io suggests. In spite of the surge in Bitcoin-oriented NFT trade volume, 30-day sales across 22 blockchains dipped 10.15% lower than the preceding month’s figures.

What are your thoughts on Blur’s dominance in the NFT lending market? Share your opinions and insights in the comments section below.