Bitcoin Leverage Ratio Shoots Up, More Volatility Ahead?

On-chain data shows the Bitcoin leverage ratio has shot up with the rise above the $30,000 mark, something that may cause more volatility for the coin.

Bitcoin Estimated Leverage Ratio Has Sharply Surged Recently

As pointed out by an analyst in a CryptoQuant post, market participants have responded to the price surge by opening high-leverage positions. The “estimated leverage ratio” is an indicator that measures the ratio between the Bitcoin open interest and derivative exchange reserve.

Here, the former is a metric that measures the total amount of positions that investors have opened on the futures market, while the latter tells us about the supply sitting in the wallets of all derivative exchanges.

When the leverage ratio has a high value, it means the average futures contract holder is taking on a high amount of leverage, implying that users are willing to take on high risk right now. Generally, such market conditions lead to the price of the cryptocurrency turning more volatile.

On the other hand, low values of the metric suggest the holders aren’t willing to take on much leverage currently. Naturally, the BTC value can become more stable while this kind of trend lasts.

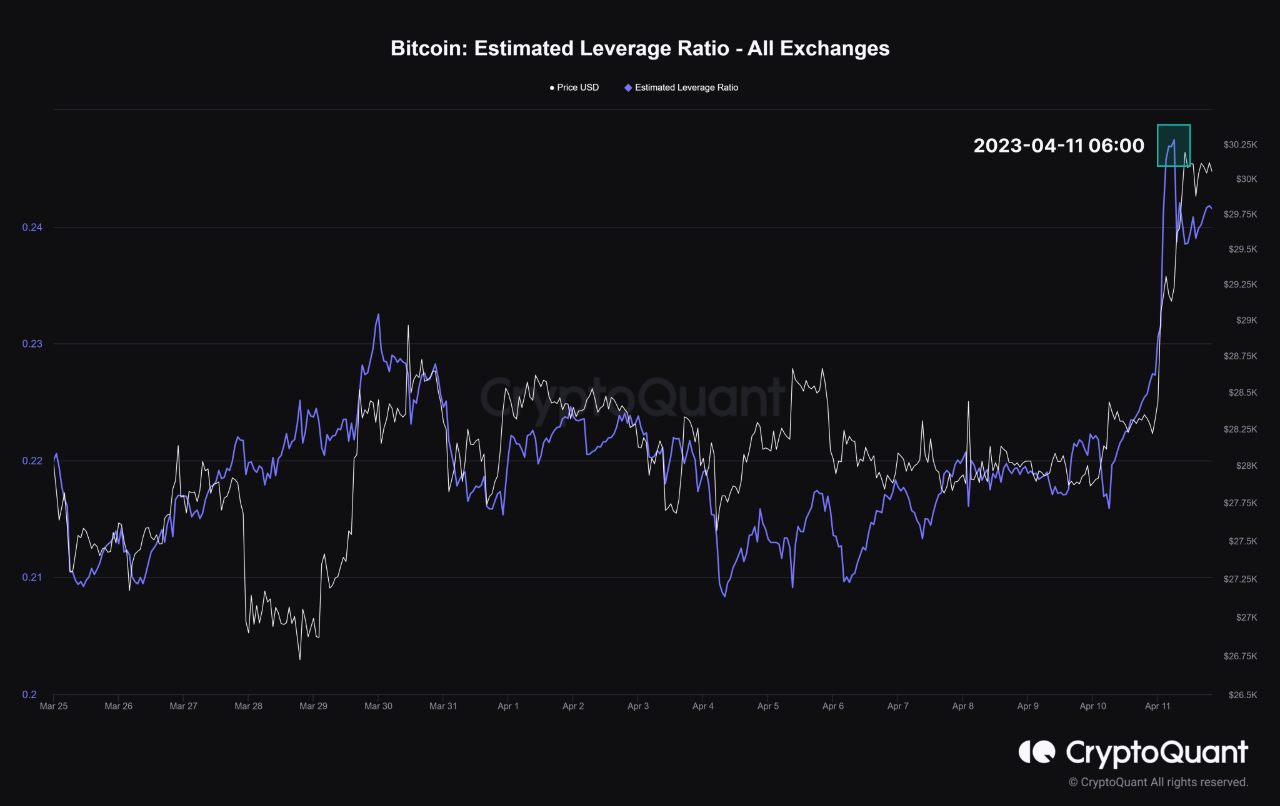

Now, here is a chart that shows the trend in the Bitcoin estimated leverage ratio over the last few weeks:

As shown in the above graph, the Bitcoin estimated leverage ratio has rapidly risen in the last couple of days as the price of the cryptocurrency has broken above the $30,000 mark for the first time in about 10 months. This means that investors have started to open positions on the futures market with a high amount of average leverage.

When leverage is high in the market, a large number of liquidations can take place at once if a sharp enough swing in the price takes place. Such mass liquidations generally only end up fueling the price move that caused them further, thus leading to even more liquidations in the process.

When liquidations cascade together in this fashion, the event is termed a “liquidation squeeze.” This type of occurrence is the reason why markets with high leverage can turn quite volatile.

Since the leverage ratio has shot up recently, a squeeze may now be more probable to take place in the near future. Any volatility that may result from this, however, can go either way.

But considering that the indicator’s value has risen with the price, it’s possible that a lot of long positions have amassed in the market, implying that a long squeeze may be more likely. If such a squeeze does take place, the price would take a bearish hit.

BTC Price

At the time of writing, Bitcoin is trading around $30,000, up 5% in the last week.