Free From Coercion and Theft: The Counter-Economic Potential of Cryptocurrencies

As nations become more authoritarian, the crypto economy and its related technologies stand out as powerful counterpoints to overreaching governance. The following Learning and Insights editorial explores why libertarians, especially agorists, embrace digital currencies such as bitcoin and tools of the crypto economy in pursuit of greater individual freedom for all.

Crypto’s Liberation: Empowering Individual Freedom Amidst Growing Authoritarianism

Last week, Bitcoin.com discussed how bitcoin (BTC) applies to Carl Menger’s theory of money and how prominent libertarian economists perceive the evolution of money. The following is an examination of why libertarians and individuals described as agorists believe the crypto economy helps fuel the counter-economy. Agorism advocates, also known as agorists, bolster counter-economic activity, which involves voluntary exchanges and arrangements that circumvent the state’s regulations, restrictions, taxation, and interventions.

Counter-economics refers to all peaceful economic transactions between consenting individuals that are prohibited by the state or beyond the legal realm of today’s traditional finance (tradfi) systems. Agorists believe that through counter-economic activity, people can increase their autonomy and reduce the power and legitimacy of the state. Essentially, the goal of agorism is an open marketplace or “agora” free from coercion and theft, with maximum individual liberty for all.

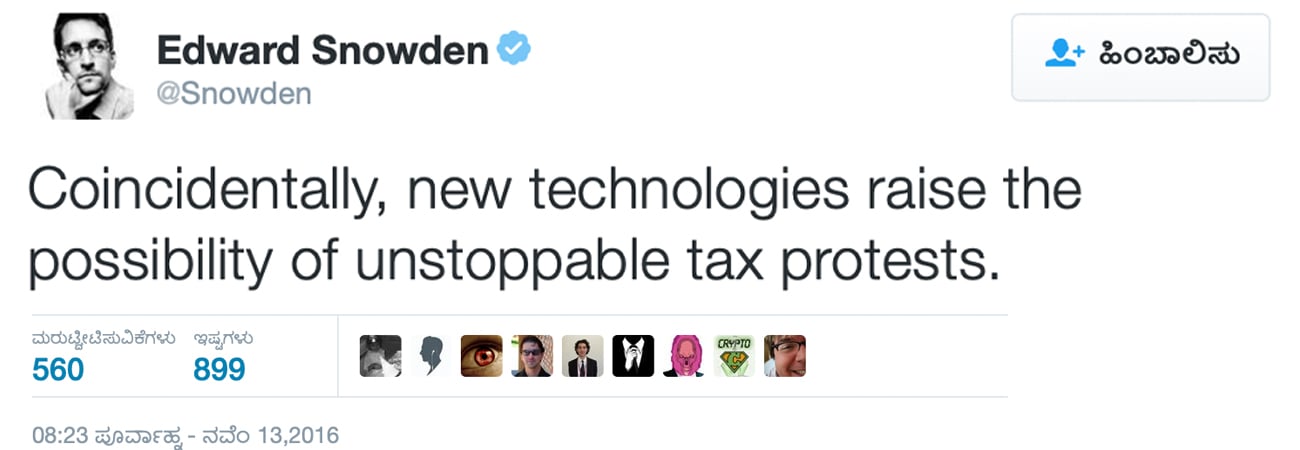

The digital currency bitcoin (BTC) and the crypto economy offer exciting possibilities for those seeking counter-economic solutions to state power. Crypto assets like BTC allow for pseudonymous, censorship-resistant transactions outside the traditional financial system. When paired with privacy techniques like Coinjoin, Cash Fusion for Bitcoin Cash (BCH), or privacy tokens like monero (XMR), the technologies can enable untraceable exchange of value. This privacy-enhancing advantage makes it a powerful tool for agorists and counter-economists.

As described in “An Agorist Primer” by Samuel Edward Konkin III (SEK3), counter-economics is the practice of all peaceful human action committed in defiance of the state. Agorism seeks to expand the counter-economy until it overwhelms statist controls. Crypto assets are uniquely suited for counter-economic activity. The decentralized design means there are fewer central points of control for states to attack. As a purely digital currency, assets like BTC enable instant, global transfers of value that ignore national borders and restrictions.

The key benefits of bitcoin and the crypto economy’s tools for counter-economics are:

- Pseudonymity: Certain crypto addresses aren’t directly linked to real-world identities, obscuring who is sending or receiving digital currencies.

- Permissionless: Anyone can download a crypto wallet and start transacting without needing approval from any authority. There are no gatekeepers to censor transactions.

- Unconfiscatable: Crypto assets aren’t physical, so they can’t be easily seized at borders or through raids. Private keys provide sole control over funds.

- Uninflationary: Bitcoin’s monetary policy is fixed, with new supply issuance declining over time. This prevents manipulative inflation that harms savers.

- Borderless: Crypto assets like BTC or XMR enable instant global transactions, bypassing geographic restrictions and capital controls.

- Censorship-resistant: The decentralized Bitcoin network has no single point of control, making it immune to shutdowns or transaction blocking by centralized entities.

- Programmable: Smart contract-powered blockchains allow attaching conditions to transactions, enabling automated escrow, time-locked releases, and other advanced functions.

Agorists can leverage these attributes to safely and privately engage in counter-economic activity. For example, crypto assets enable the trading of prohibited goods and services across borders that would otherwise be blocked. They also facilitate untaxed economic transactions by not recording identities and values transacted. This censorship resistance protects agorist institutions from being shut down or blocked by the state.

As crypto adoption expands, more avenues open for counter-economic activity. Decentralized exchanges (DEXs) connect pseudonymous buyers and sellers directly for untraceable trades. Anonymity networks like Tor conceal users’ locations and internet activity when transacting with a variety of digital assets.

In summary, Bitcoin and its technological innovations empower counter-economics and agorist philosophy. Its key attributes align with countering state controls and expanding personal and economic freedom. The crypto economy can bring us closer to the agorist vision of a society operating through voluntary exchange in a fully-developed counter-economy.

This crypto economy essentially provides tools for individuals to safely ignore unjust state dictates over their peaceful economic activities. For well over a decade, the crypto economy has bolstered self-liberation both through its use in counter-economic trade and by allowing people to individually secede from state-controlled money.

Do you want to learn more about Agorism? Check out the links below:

- Samuel E Konkin III (SEK3): The Agorist Primer

- Peter Kallman: A 21st Century Introduction to Agorism

What do you think about the relationship between cryptocurrencies and Agorism? Let us know your thoughts on the subject in the comments section below.