Stablecoins Volume Down Despite Crypto Market Recovery, Ratings Agency Finds

Stablecoins, the digital assets designed to maintain a stable value, have long been viewed as a potential bridge between the cryptocurrency world and the traditional financial industry. However, recent developments have cast a shadow of uncertainty over their perceived stability.

As global policymakers continue to grapple with concerns about the crypto sector’s impact on the established financial system, a surprising twist occurred when stress in the US banking industry reverberated throughout the stablecoin market.

According to Fitch Ratings, the tightening of financial conditions, culminating in the high-profile failures of several banks, notably including the collapse of the esteemed Silicon Valley Bank, had a profound impact on stablecoins.

Stablecoins: Market Shakeup

For instance, Fitch Ratings reports that the market capitalization of USD Coin (USDC), a stablecoin pegged to the US dollar at a 1:1 ratio, experienced a sharp decline of over 25% in the first quarter. Although the coin’s value remains depressed, Fitch noted that it managed to recover its peg soon after.

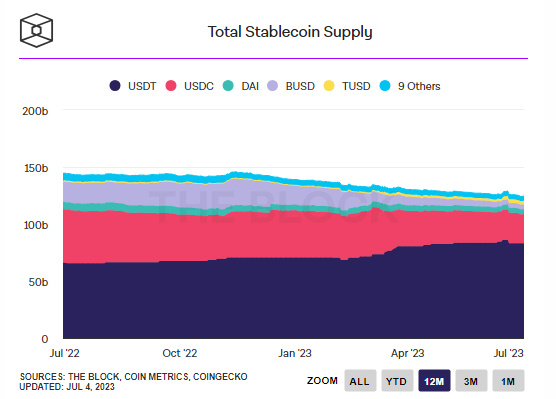

According to data from The Block, the total supply of stablecoins has decreased from $138 billion at the beginning of the year to $124 billion as of July 3. This decline in supply further underscores the challenges faced by stablecoins and their struggle to maintain stability amidst market turbulence.

“Significant volatility, shaken investor confidence, and temporary but sharp de-pegging occurred in the stablecoin market in March as shockwaves spread from traditional finance,” Fitch wrote.

Tether Bucks Trend

In contrast to USDC, Tether, another prominent stablecoin, observed a 12% increase in its market capitalization during the same period. Notably, Tether captured approximately 72% of USDC’s redemption volume, indicating a growing preference for Tether among investors.

Despite Tether’s positive performance, the top 10 stablecoins experienced a decline in their monthly average of daily trading volumes. From March to May 2023, these trading volumes decreased from $53 billion to $28 billion.

This reduction signifies a decrease in activity within the stablecoin market, possibly driven by cautious investor sentiment in the face of ongoing market uncertainties.

Fitch noted that efforts to regulate stablecoins have been unfolding at varying speeds in the United States and Europe, leading to notable differences in the reporting and transparency standards of these digital assets.

The contrasting approaches taken by the two regions have resulted in distinct regulatory landscapes for stablecoins, causing direct consequences on their reporting and transparency practices.

(The information provided on this website should not be interpreted as investment advice. Investing carries inherent risks, and when you make investments, there is a possibility of experiencing capital loss due to these risks).

Featured image from Zebpay