White House Says Biden Has ‘Confidence’ in Fed Chair Powell While Fedwatch Tool Predicts a 25bps Hike This Week

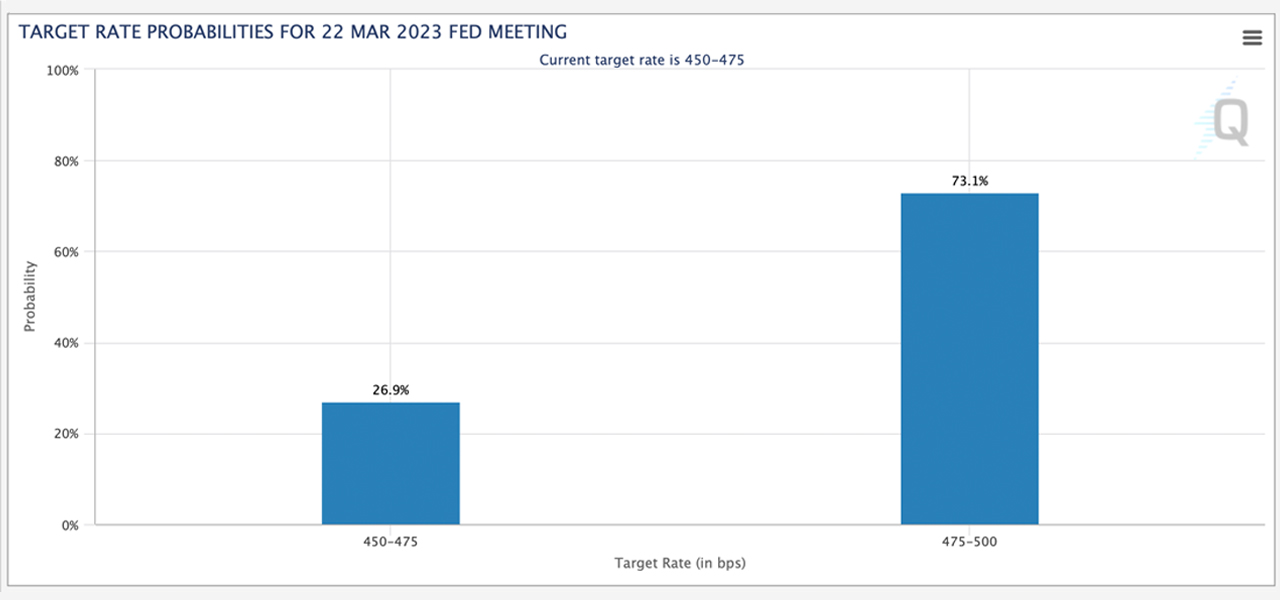

With the Federal Open Market Committee convening on Wednesday and the recent financial troubles facing the U.S. banking system, White House press secretary Karine Jean-Pierre said President Joe Biden has “confidence” in Federal Reserve chair Jerome Powell. Meanwhile, according to the CME Group’s Fedwatch tool, the target rate probability suggests the Fed will raise the federal funds rate by 25 basis points (bps) this week. There’s also a 26.9% chance the U.S. central bank won’t raise the rate this month.

Market Laser-Focused on Upcoming Fed Meeting; Biden Administration Confident in Powell’s Leadership

It has been a tumultuous week in the U.S. banking industry as three major banks collapsed, and the Federal Reserve announced that it would fully bail out two of them. Additionally, the U.S. central bank created the Bank Term Funding Program (BTFP) to assist failed banks and their depositors. Moreover, the Fed loaned the banks $164.8 billion to strengthen liquidity and collaborated on March 19 with five other major central banks to boost U.S. dollar liquidity.

To make matters worse, a recently published paper indicates that roughly 186 U.S. banks are grappling with the same problems as Silicon Valley Bank, and First Republic Bank’s stock plummeted on March 20, losing more than 40% of its value in a single day. In the meantime, on March 22, the Federal Open Market Committee (FOMC) and Fed chair Jerome Powell will determine the fate of the federal funds rate.

Prior to the banking industry fallout, the U.S. central bank had been raising the benchmark rate rapidly every month since this time last year, following the significant monetary expansion in response to the Covid-19 pandemic, which saw the institution keeping rates suppressed at zero. When inflation began to soar, Fed members, including chair Powell, referred to it as “transitory” and predicted it wouldn’t last.

However, the Fed’s swift monetary tightening in response to inflation has caused significant issues with long-duration Treasury notes. During the White House press briefing on Monday, press secretary Karine Jean-Pierre was asked about president Biden’s opinion of the Fed chair’s leadership and whether Powell might be replaced as the Fed’s head. “No, not at all. The president has confidence in Jerome Powell,” Jean-Pierre stated.

Eight days prior, on March 13, president Biden had reassured Americans that the U.S. banking system was secure. “Americans can rest assured that our banking system is safe,” he said. “Your deposits are secure. Let me also assure you that we will not stop here. We will do whatever is necessary,” the U.S. president added.

Additionally, market strategists and economists are curious about the Fed’s plans for Wednesday, with some speculating that the central bank will be dovish. For example, last week, Goldman Sachs chief economist Jan Hatzius revised the bank’s U.S. federal funds rate forecast and stated that he does not expect a hike on Wednesday.

Other market analysts anticipate that the Fed will raise the rate by 25 basis points (bps) this week. At the time of writing, the CME Group Fedwatch tool indicates a 73.1% chance that the 25bps rate increase will occur. The Fedwatch tool also indicates that 26.9% of analysts predict no rate hike this month.

What do you think the Fed’s decision will be this coming Wednesday? Share your thoughts about this subject in the comments section below.